Swisscanto CIO Survey: Gold and AI Stocks in Focus

The first edition of the Swisscanto CIO Survey highlights how Chief Investment Officers (CIOs) from Swiss financial institutions assess the development of various asset classes and their respective asset allocation strategies over a six-month period. The survey provides valuable insights into the positioning and market opinions of Swiss financial institutions.

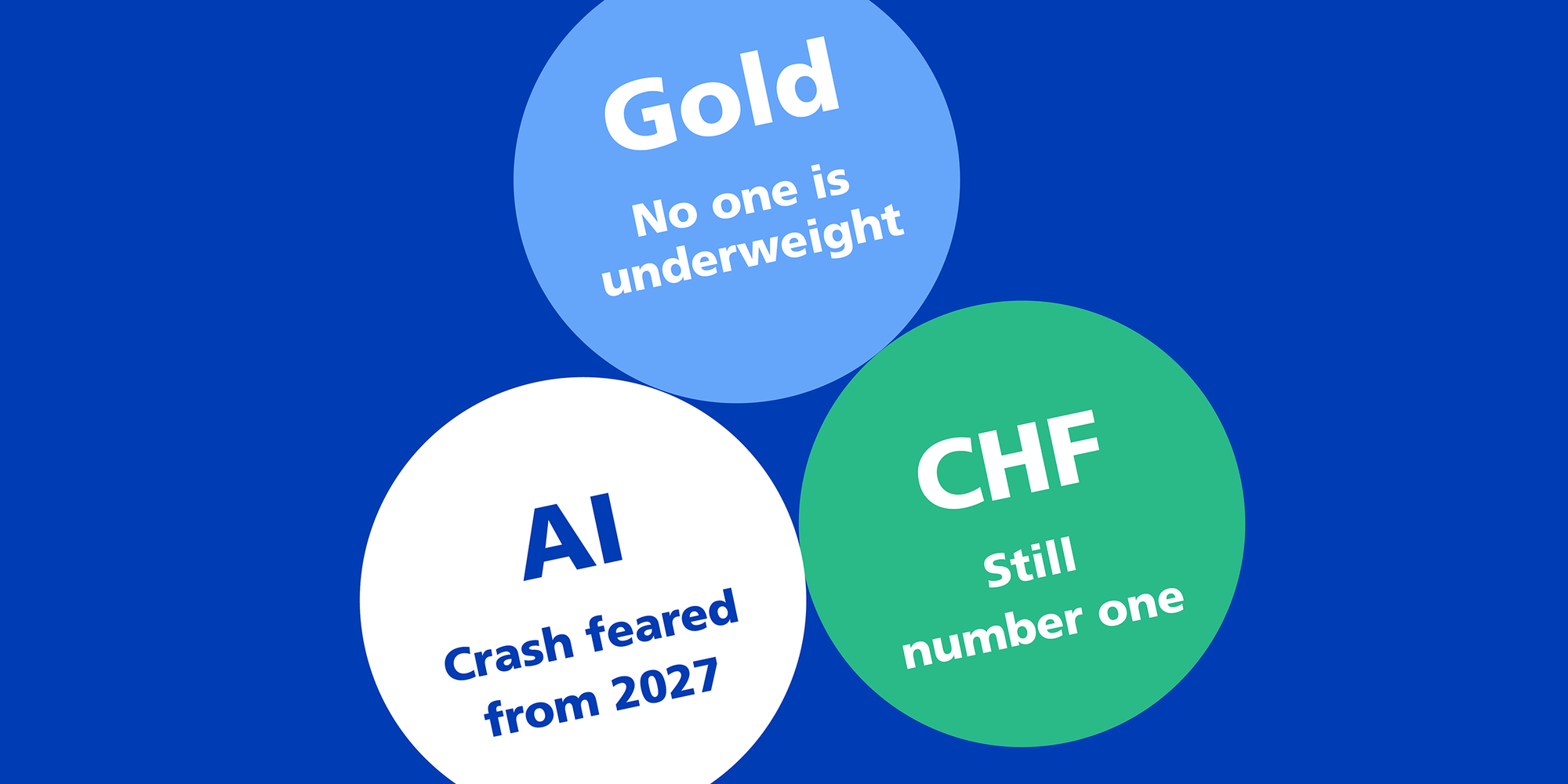

- Loved vs shunned: The most popular asset class among the typical nine categories for CHF investors is gold, while, unsurprisingly, CHF bonds receive the least support.

- Sentiment: Around half of the CIOs have overweighted equities in their portfolios, and only about 10% are underweight. This indicates an optimistic outlook and a positive sentiment towards equity markets (“bullish sentiment”).

- Surprise: Only 10% of the surveyed CIOs expect negative returns on ten-year Swiss government bonds. This, despite the fact that yields for maturities of up to five years are already negative, while inflation and key interest rates stand at 0%.

Loved: Real assets like gold and real estate

The survey results show that, despite a doubling of the gold price within two years, only 8% of the surveyed CIOs expect a lower gold price over the next six months (see Chart 1). It is also noteworthy that none of the experts surveyed have underweighted gold in their portfolios, and no one expects the price to drop below USD 3,500 per ounce. On the contrary, almost a third of CIOs anticipate another sharp price increase to over USD 4,500.

This high level of optimism could indicate a certain euphoria, which might also serve as a potential warning signal.

Chart 1: Where will the price of gold be in 6 months (USD per ounce)?

Chart 1: Where will the price of gold be in 6 months (USD per ounce)?

A similar picture emerges for listed Swiss real estate funds (see Chart 2): Despite high premiums (over 35% above net asset value, NAV), nearly 90% of respondents expect moderate performance of 0 to 6%. Only 10% of CIOs anticipate declining prices.

Chart 2: Performance of Swiss listed real estate funds over the next 6 months?

Chart 2: Performance of Swiss listed real estate funds over the next 6 months?

Shunned: CHF bonds

Swiss bonds are considered a safe haven – and for good reason. Unlike other countries, Switzerland faces low debt and inflation issues, and Swiss corporate bonds are also of high quality.

However, this is precisely why the index now offers only low return expectations, which the surveyed CIOs deem unattractive: 82% have underweighted CHF bonds in their current tactical asset allocation (see Chart 3). This aligns with the expectation that Swiss government bond yields will not turn negative. Only 10% of the surveyed CIOs foresee a return to negative yields (as seen between 2015 and 2021). This is despite the fact that yields for maturities of up to five years are already negative, while inflation and key interest rates remain at 0%. This is the most surprising finding of this survey.

Global government bonds are also being shunned. Only 6% of respondents have overweighted them, while 63% have underweighted them in their allocation.

Chart 3: Current tactical asset allocation

CIOs see no immediate bubble in AI

As part of the Swisscanto CIO Survey, the participating CIOs were asked to assess the current market developments in the field of Artificial Intelligence (AI). The results revealed a divided opinion: 45% of respondents do not view the current situation as a bubble. At the same time, nearly half of the CIOs expect a crash to occur between 2027 and 2030. Despite the current prominence of the topic in the public sphere, only 9% of respondents expect such a scenario to occur as early as 2026 (Chart 4).

The results suggest that while the majority of CIOs recognise potential risks in the AI sector, they expect these risks to materialise in the medium term.

Chart 4: When will the AI bubble burst?

Chart 4: When will the AI bubble burst?

Swiss Equities in the Middle, Emerging Markets on Top

Survey participants ranked the equity regions "Emerging Markets" and "USA" as the most attractive, followed by Swiss equities. Europe and Japan were placed at the bottom of the rankings.

Interestingly, both the US S&P 500 and the MSCI Emerging Markets indices have significant exposure to AI companies. Despite the aforementioned medium-term risk of losses, CIOs are heavily investing in this technology.

For Swiss equities, however, there is no clear consensus: 51% of respondents rate them as neutral, while 9% are underweight, and 41% are overweight.

An interesting result emerges in investment strategies: Despite weak performance in 2025, the "Quality" factor remains a focus for CIOs. At the same time, the "Growth" factor is significantly more popular than "Value." Small caps, which have underperformed compared to large caps, are also viewed as less attractive by respondents.

Swiss Franc Remains No. 1

64% of the surveyed CIOs consider the Swiss Franc to be the most attractive currency (Chart 5), despite its significant appreciation this year. This underscores its role as a "safe haven." Among foreign currencies, the Canadian Dollar and the British Pound are viewed as unattractive, while the Euro is currently the most favoured foreign currency.

While the preference for the Swiss Franc would typically suggest that foreign currency risks should be hedged accordingly, the survey shows that only a minority of respondents (14%) intend to increase currency hedging. A possible reason for this could be the still high hedging costs of up to 3% in the case of the US Dollar.

Conclusion

Real assets such as gold, equities, and real estate are significantly more in demand than bonds. However, the unanimous optimism surrounding gold could serve as a warning sign for potential price corrections. Overall, the sentiment among CIOs is optimistic but not excessively euphoric. For the first half of 2026, respondents expect positive financial market returns, accompanied by a continued strong Swiss Franc.

About the Survey

The new Swisscanto CIO Survey, conducted by the Multi Asset team at Zürcher Kantonalbank Asset Management, provides a structured and systematic insight into the market assessments of Swiss Chief Investment Officers (CIOs) for the first time. The survey is based on a set of predominantly consistent questions aimed at gathering additional information on market assessments and offering valuable insights to investors. The survey is conducted twice a year.

The survey was carried out between 24 November and 8 December 2025. A total of 130 CIOs were invited to participate, of which 51 responded. The survey questions cover a six-month time horizon and address various aspects of market assessment.

Participating institutions include, among others: Aargauische Kantonalbank, Baloise Asset Management, Banque Cantonale du Jura, Berner Kantonalbank, Decalia Asset Management, Genvil Wealth Management & Consulting, Globalance Bank, Graubündner Kantonalbank, Habib Bank AG Zurich, Liechtensteinische Landesbank LLB, Lienhardt & Partner, LoyalFinance, Luzerner Kantonalbank, Migros Bank, Mirabaud, Numan Wealth Partners, Pictet Asset Management, Probus Pleion, Privatbank Bellerive, Rahn+Bodmer CO., J. Safra Sarasin, Schaffhauser Kantonalbank, Schwyzer Kantonalbank, St. Galler Kantonalbank, Valiant Bank, VI Vorsorge, Wyss Partner, XO Investments, Zuger Kantonalbank, and Zugerberg Finanz.

Legal Notice Switzerland

Legal Notice Switzerland

In writing this blog post, Zürcher Kantonalbank has based its analysis on the market expectations of Swiss CIOs.

This document was prepared by Zürcher Kantonalbank and is intended for distribution in Switzerland. It is not intended for people in other countries. Unless otherwise stated, the information refers to Zürcher Kantonalbank's asset management, which includes collective investment schemes under Swiss and/or Luxembourg and/or Irish law (hereinafter referred to as «Swisscanto Funds») and/or investment groups of Swisscanto Investment Foundations and/or asset management mandates of Zürcher Kantonalbank. This information is for advertising and information purposes only and does not constitute investment advice or an investment recommendation. This document does not constitute a sales offer or an invitation or solicitation to subscribe to or to make an offer to buy any financial instruments, nor does it form the basis of any contract or obligation of any kind. The investment opinions and assessments of securities and/or issuers contained in this document have not been prepared in accordance with the rules on the independence of financial analysts and therefore constitute marketing communications (and not independent financial analysis). In particular, the employees responsible for such opinions and assessments are not necessarily subject to restrictions on trading in the relevant securities and may in principle conduct their own transactions or transactions for Zürcher Kantonalbank in these securities. The sole binding basis for the acquisition of Swisscanto Funds is the respective published documents (fund agreements, contractual conditions, prospectuses and key investor information, as well as annual reports). These can be obtained free of charge from products.swisscanto.com/ or in paper form from Swisscanto Fund Management Company Ltd., Bahnhofstrasse 9, CH-8001 Zurich, which is the representative for Luxembourg funds, and at all branch offices of Zürcher Kantonalbank, Zurich. Carne Global Fund Managers (Schweiz) AG is the representative for funds domiciled in Ireland. Zürcher Kantonalbank is the paying agent for the Irish Swisscanto funds in Switzerland and Luxembourg funds. The information contained in this document has been prepared with customary diligence. However, no guarantee can be provided as to the accuracy and completeness of the information. The information contained in this document is subject to change at any time. No liability is accepted for the consequences of investments based on this document. Every investment involves risks, especially with regard to fluctuations in value and return. With regard to any information on sustainability, it should be noted that there is no generally accepted framework and no generally valid list of factors in Switzerland that need to be taken into account to ensure the sustainability of investments. For Irish and Luxembourg Swisscanto funds, information on sustainability-related aspects in accordance with the Disclosure Regulation (EU) 2019/2088 is available at products.swisscanto.com/ The products and services described in this document are not available to US persons in accordance with the applicable regulations. This document and the information contained in it must not be distributed and/or redistributed to, used or relied upon by, any person (whether individual or entity) who may be a US person under Regulation S of the US Securities Act of 1933. US persons include any US resident; any corporation, company, partnership or other entity organised under any law of the United States; and other categories set out in Regulation S. Status of the data (unless otherwise stated): 11.2025

© 2025 Zürcher Kantonalbank. All rights reserved.

Legal Notice International

Legal Notice International

In writing this blog post, Zürcher Kantonalbank has based its analysis on the market expectations of Swiss CIOs.

This document only serves advertising and information purposes and is not directed at persons in whose nationality or place of residence prohibit access to such information under applicable law. Where not indicated otherwise, the information concerns the collective investment schemes under the law of Luxembourg managed by Swisscanto Asset Management International S.A. (hereinafter "Swisscanto Funds"). The products described are undertakings for collective investment in transferable securities (UCITS) within the meaning of EU Directive 2009/65/EC, which is governed by Luxembourg law and subject to the supervision of the Luxembourg supervisory authority (CSSF). This document does not constitute a solicitation or invitation to subscribe or make an offer to purchase any securities, nor does it form the basis of any contract or obligation of any kind. The sole binding basis for the acquisition of Swisscanto Funds are the respective published legal documents (management regulations, sales prospectuses and key information documents (PRIIP KID), as well as financial reports), which can be obtained free of charge at products.swisscanto.com/. Information about the sustainability-relevant aspects in accordance with the Regulation (EU) 2019/2088 as well as Swisscanto's strategy for the promotion of sustainability and the pursuit of sustainability goals in the fund investment process are available on the same website. The distribution of the fund may be suspended at any time. Investors will be informed about the deregistration in due time. The investment involves risks, in particular those of fluctuations in value and earnings. Investments in foreign currencies are subject to exchange rate fluctuations. Past performance is neither an indicator nor a guarantee of future success. The risks are described in the sales prospectus and in the PRIIP KID. The information contained in this document has been compiled with the greatest care. Despite professional procedures, the correctness, completeness and topicality of the information cannot be guaranteed. Any liability for investments based on this document will be rejected. The opinions and assessments contained in this document regarding securities and/or issuers have not been prepared in accordance with the regulations governing the independence of financial analysts and therefore constitute marketing communications (and not independent financial analyses). In particular, the employees responsible for such opinions and assessments are not necessarily subject to restrictions on trading the relevant securities and may, in principle, conduct their own transactions in these securities. The document does not release the recipient from his or her own judgment. In particular, the recipient is recommended to check the information for compatibility with his or her personal circumstances as well as for legal, tax and other consequences, if necessary, with the help of an advisor. The prospectus and PRIIP KID should be read before making any final investment decision. An overview of investors' rights is available at swisscanto.com/int/en/legal/summary-of-investor-rights.html.

The products described in this document are not available to U.S. persons under the relevant regulations (in particular Regulation S under the U.S. Securities Act of 1933).

Data as at (where not stated otherwise): 11.2025.

© Swisscanto Asset Management International S.A. All rights reserved.