Bonds: Emerging Markets and Australia

Yields on US government bonds have been rising again since the start of the year. The reasons behind this are renewed verbal attacks by US President Donald Trump on Europe and strong economic data. Additionally, the US Supreme Court's decision regarding trade tariffs is pending, which could significantly increase pressure on the federal budget. While we generally find global government bonds attractive at current yield levels, we see more opportunities in emerging markets or Australia. For corporate bonds, we maintain our underweight position and prefer to take risks in equities and convertible bonds, where we see significantly greater upside potential. We also remain heavily underweight in CHF bonds, which we consider to be relatively unattractive.

Equities: Barbell Strategy repositioned

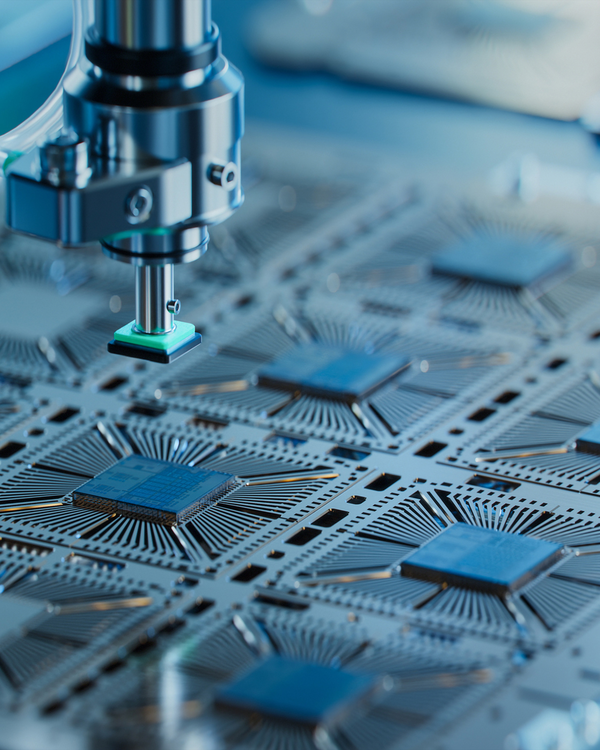

In recent months, we have followed a barbell strategy focused on tech and pharma. We are now selling pharmaceutical stocks and instead buying global small caps. This move aims to capitalise on the momentum of the cyclical upswing. On the other hand, we are increasing our overweight in the IT sector. Since last October, IT has somewhat fallen out of focus and has been moving sideways. However, as the fundamentals remain very strong, valuations have significantly improved compared to the broader market (chart below). We are also making additional purchases in emerging market equities, which we believe show strong momentum. As a result, we are increasing our equity overweight to 3%.