Swiss Small & Mid Caps: Ideal conditions for active management

Swiss Small & Mid Cap stocks are ideal as an active alpha source, explains Felix Morger in the interview. The Senior Portfolio Manager for Swiss Small & Mid Caps elaborates on how his team and he identify attractive investment opportunities.

The key takeaways from the interview

- Even in 2026, Swiss Small & Mid Caps are likely to remain popular among investors as profit growth is expected to accelerate after a phase of consolidation.

- Thanks to the diversity of the Swiss Small & Mid Cap Index (SPIEX), both pair trades and thematic plays are possible from an investment perspective.

- When assembling a Small & Mid Caps portfolio, it is crucial to focus on stable alpha development, with quality playing a decisive role.

Felix, Small & Mid Caps delivered strong performance in 2025 and have had a good start to 2026. What makes them an attractive investment in the current environment?

Felix Morger: Indeed, Swiss Small & Mid Caps performed exceptionally well in 2025 despite some challenges, such as U.S. tariff policies. The reduction of the long-standing valuation premium compared to the Swiss Blue Chip Index SMI at the beginning of the year and the interest in companies with a high share of domestic revenue were key factors.

And what’s next?

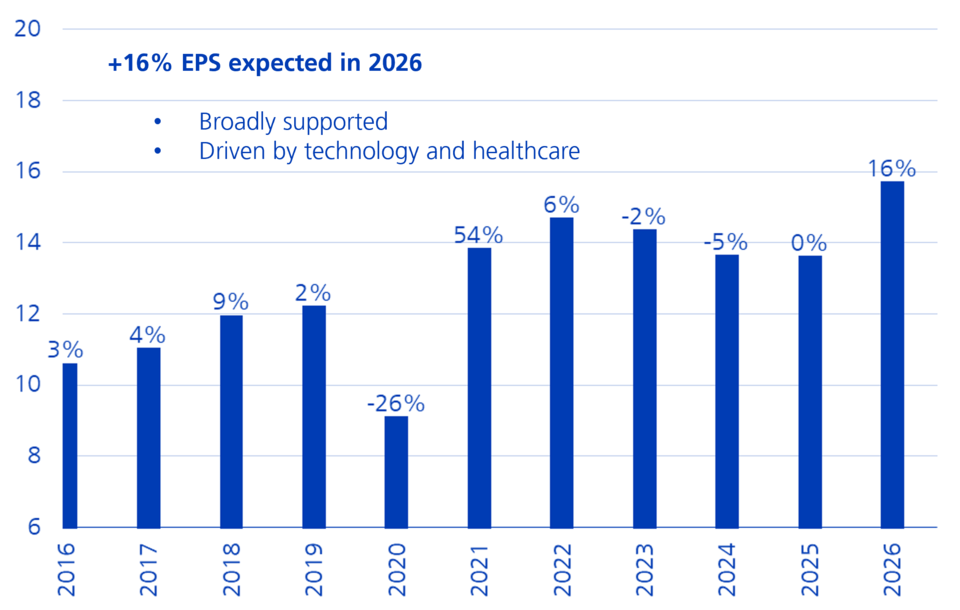

In 2026, I believe Small & Mid Caps will continue to attract investors as profit growth is expected to accelerate after a period of consolidation. This anticipated growth is driven by the healthcare and technology sectors, while only moderate growth is expected in the financial sector. Overall, the trend is broadly supported.

Strong Earnings Growth in the SPIEX (Earnings per Share EPS in %)

Blue chips play a significant role in the Swiss stock market, with the healthcare, financial, and food sectors dominating. How does the composition of Swiss Small & Mid Caps differ?

The Swiss Small & Mid Caps index SPIEX is more balanced and diverse. It includes a broader range of sectors and more companies within each sector. This allows for the implementation of “pair trades,” where one stock within a sector is overweighted while another with a similar business model is underweighted. Additionally, the diversity of the SPIEX enables the inclusion of various current themes, such as data centers, energy transition, aerospace, and intralogistics within the industrial sector.

Our approach has worked exceptionally well in recent years.

Dr. Felix Morger, Senior Portfolio Manager for Swiss Small & Mid Caps

What does this mean in practice?

These two elements—pair trades and thematic plays—can be implemented within each sector. This makes portfolio construction much more dynamic and allows for a wide range of potential alpha sources, i.e., sources of market outperformance.

Diverse SPIEX: Diversification favors Swiss Small & Mid Caps (Sector Shares in %)

You are responsible for the Swisscanto Small & Mid Caps strategies. What are the key factors in stock selection?

We select stocks through detailed bottom-up research. Our team at the Asset Management of Zürcher Kantonalbank analyses companies based on their products, market position, balance sheet quality, and valuation. In addition to desk research, we maintain regular dialogue with company management and, where appropriate, their boards of directors. This allows us to validate our insights and address governance issues at the board level.

Stability and diversified alpha potential through thoughtful portfolio construction

Could you briefly explain how you construct a portfolio?

We assemble a portfolio based on our analyses and discussions. Our goal is to achieve the most stable and positive alpha development possible while avoiding pronounced sector and style exposures. To achieve this, we use quantitative elements and apply numerical portfolio optimization. The aim is for the quality of our stock selection to drive alpha, with minimal influence from overall market movements.

How has this approach performed in practice?

In our view, this approach has worked exceptionally well in recent years, as evidenced by the historical performance of our funds. For instance, the strategy achieved a total outperformance of 4.6% over three years, or approximately 1.4% per year compared to the benchmark. However, it is important to note that past performance is not indicative of future returns.

How the Swisscanto Small & Mid Cap Strategy has fared over the years

Performance comparison between the Swisscanto Small & Mid Caps Switzerland (II) Strategy (“SWC SMC II”), the benchmark SPIEX, and the Morningstar peer group category “Switzerland Small/Mid-Cap Equity” as of the end of December 2025.

It should be noted that any information regarding historical performance is not an indicator of current or future performance, and any performance data provided may not take into account the commissions and costs incurred when issuing and redeeming fund units. The net performance of the respective fund is available upon request.

Funds in Focus

Funds in Focus

Legal Notice

Legal Notice

Historical performance is not an indicator of current or future performance, and performance data may not account for commissions and costs incurred when issuing and redeeming fund units.

Legal notices regarding the charts: “BLOOMBERG®” and the Bloomberg indices listed herein (the “Indices”) are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the Indices (collectively, “Bloomberg”) and have been licensed for use for certain purposes by the distributor hereof (the “Licensee”). Bloomberg is not affiliated with Licensee, and Bloomberg does not approve, endorse, review, or recommend the financial products named herein (the “Products”). Bloomberg does not guarantee the timeliness, accuracy, or completeness of any data or information relating to the Products.

This document was prepared by Zürcher Kantonalbank and is intended for distribution in Switzerland. It is not intended for people in other countries. Unless otherwise stated, the information refers to Zürcher Kantonalbank's asset management, which includes collective investment schemes under Swiss and/or Luxembourg and/or Irish law (hereinafter referred to as «Swisscanto Funds») and/or investment groups of Swisscanto Investment Foundations and/or asset management mandates of Zürcher Kantonalbank. This information is for advertising and information purposes only and does not constitute investment advice or an investment recommendation. This document does not constitute a sales offer or an invitation or solicitation to subscribe to or to make an offer to buy any financial instruments, nor does it form the basis of any contract or obligation of any kind. The investment opinions and assessments of securities and/or issuers contained in this document have not been prepared in accordance with the rules on the independence of financial analysts and therefore constitute marketing communications (and not independent financial analysis). In particular, the employees responsible for such opinions and assessments are not necessarily subject to restrictions on trading in the relevant securities and may in principle conduct their own transactions or transactions for Zürcher Kantonalbank in these securities. The sole binding basis for the acquisition of Swisscanto Funds is the respective published documents (fund agreements, contractual conditions, prospectuses and key investor information, as well as annual reports). These can be obtained free of charge from products.swisscanto.com/ or in paper form from Swisscanto Fund Management Company Ltd., Bahnhofstrasse 9, CH-8001 Zurich, which is the representative for Luxembourg funds, and at all branch offices of Zürcher Kantonalbank, Zurich. Carne Global Fund Managers (Schweiz) AG is the representative for funds domiciled in Ireland. Zürcher Kantonalbank is the paying agent for the Irish Swisscanto funds in Switzerland and Luxembourg funds. The information contained in this document has been prepared with customary diligence. However, no guarantee can be provided as to the accuracy and completeness of the information. The information contained in this document is subject to change at any time. No liability is accepted for the consequences of investments based on this document. Every investment involves risks, especially with regard to fluctuations in value and return. With regard to any information on sustainability, it should be noted that there is no generally accepted framework and no generally valid list of factors in Switzerland that need to be taken into account to ensure the sustainability of investments. For Irish and Luxembourg Swisscanto funds, information on sustainability-related aspects in accordance with the Disclosure Regulation (EU) 2019/2088 is available at products.swisscanto.com/ The products and services described in this document are not available to US persons in accordance with the applicable regulations. This document and the information contained in it must not be distributed and/or redistributed to, used or relied upon by, any person (whether individual or entity) who may be a US person under Regulation S of the US Securities Act of 1933. US persons include any US resident; any corporation, company, partnership or other entity organised under any law of the United States; and other categories set out in Regulation S.

© 2025 Zürcher Kantonalbank. All rights reserved.