Equity markets: Rally despite resistance

September is traditionally the weakest month of the year on the stock market. In 2025, however, it defied the odds and the equity markets continued to rise. The Fed's interest rate cut (-25 basis points) gave the global AI rally further momentum. Thanks to new partnerships and lenient antitrust rulings, the American IT and telecoms sector in particular, with companies such as Oracle and Micron (both +40%) and Alphabet, were among the clear winners. Nevertheless, our sentiment indicators show no signs of euphoria, and the fundamentals remain solid. We are therefore increasing our tactical position in the Nasdaq and remain overweight in convertible bonds, which have a bias towards smaller IT issuers.

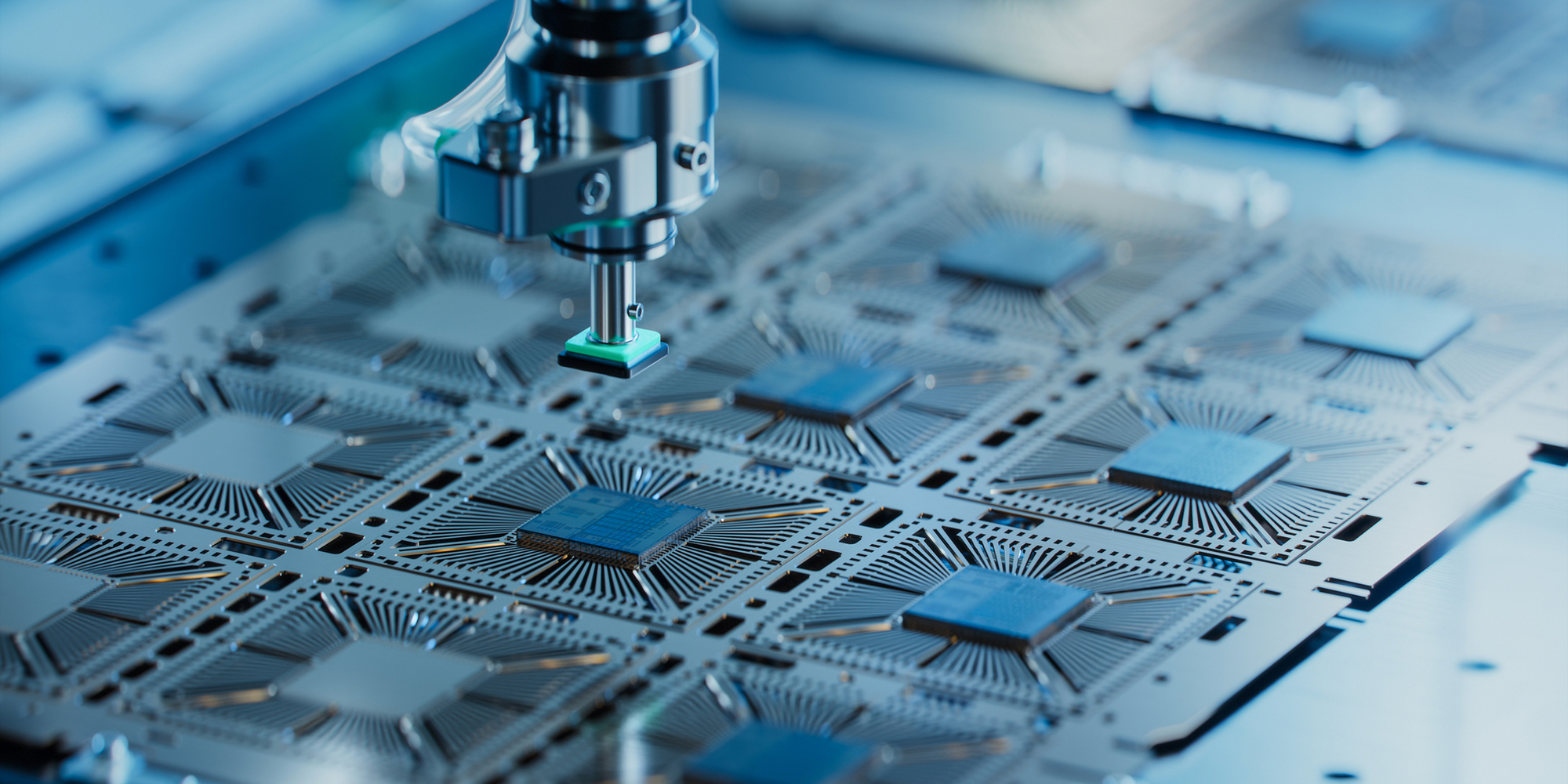

Emerging markets: tech stocks at the forefront

Tech stocks also performed well in emerging markets (see chart). Alibaba's share price shot up by an impressive 50% in September thanks to increased investment in AI infrastructure. The MSCI EM Index reached its 2007 highs and is approaching its all-time high of 2021. A weak USD, robust economic data (+4.1% GDP in 2025), low inflation (3.2%) and falling key interest rates continue to provide tailwinds. Nevertheless, we are taking some profits after the strong rally, as earnings growth has not been able to keep pace and valuations have risen (P/E ratio from 12 to 14). We also expect growth in China to slow in the second half of the year. However, our overweight in emerging market bonds remains unchanged, as they continue to benefit from historically high real yields and a weak US dollar. EM bonds also have a different regional distribution than Asia-heavy equities.