Risk-averse investors at significantly higher risk of slipping

Cautious investors who are mostly invested in bonds should slip into some non-slip shoes! We discuss which model offers a good grip.

Author: Claude Hess

COVID-19 and its economic impact has reshuffled the cards for investors. Rising inflation combined with monetary tightening has caused interest rates to soar, in turn driving bond volatility. Risk-averse investors with high bond allocations have been hit especially hard by the higher volatility. But stock market turbulence has also risen since the coronavirus crisis.

The following chart shows how the overall volatility of a balanced portfolio with 40 percent equities and 60 percent bonds has changed since the coronavirus pandemic and the contributions by the various influencing factors:

Volatility of portfolio with 40 percent equities and 60 percent bonds before and after the pandemic

The diversification effect from bonds has also weakened considerably. Prior to the pandemic, they were a useful counterbalance to equities, as they tended to have an adverse correlation to them. But post-coronavirus, this correlation has shifted significantly into positive territory, leading to an increase in risk for the portfolio.

Getting the balance right

A simple method of tackling these heightened risks is to reduce the equity share and, in return, invest in yet more bonds. Equity volatility is still higher than bond volatility, after all. But there are three reasons why this might not be the best way:

- Such a reallocation would make the portfolio even more dependent on bond market volatility and thus less diversified.

- Reducing the equity share would lower the profit potential in rising equity markets.

- Switching from real assets (e.g. equities) to nominal ones (e.g. bonds) would weaken inflation protection.

An attractive alternative to reducing equities: put options

One tried-and-test alternative to reducing the equity share is to hedge it with put options. This is best done with a rolling hedging strategy. As put options on equity indices have a strong adverse correlation with equity markets, they offer high diversification within a balanced portfolio. Put options of course cost money. But compared with the opportunity costs incurred by the reduction in the equity share, they are often justified and currently attractively priced.

One effect of hedging with put options is that the lower the equity markets fall, the greater the protective effect. This is also known as a convex payout profile and can be an advantage compared with a linear reduction in the equity share.

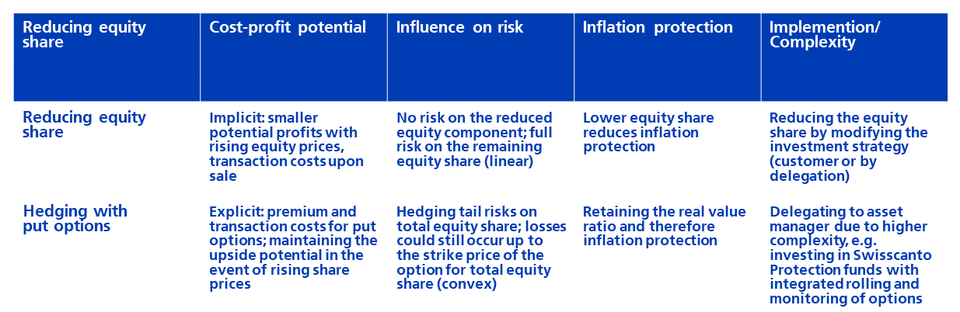

The type of risk reduction that will suit investors best will depend on their individual preferences. The following table describes the pros and cons of the reduction methods mentioned:

Summary

The post-coronavirus world has thrown up new challenges for us, especially when it comes to investment decisions. But there are ways in which investors with balanced portfolios can defend themselves against the increased risks. A rolling strategy with put options could be an appealing alternative to reducing the equity share.

More information on how assets can be protected against potential losses can be viewed in the video post: