Investing in gold? Five questions, five answers

Investors like to include precious metal in their portfolios. But why is gold currently so popular that it is constantly reaching new record highs? Read on for the answers to the most important questions and to find out why you shouldn't be too dazzled.

Cyrill Staubli and Jonathan Hopff

What opportunities does gold offer?

Gold has always been a symbol of wealth. But could investing in gold – especially given the sharp rise in prices in recent months - lead to financial prosperity?

This is supported by ...

- In the long term, gold has proven to be a stable investment, especially in times of economic uncertainty and high inflation, when it becomes more attractive. Conventional wisdom says that even if the Swiss franc and the US dollar lose value, one ounce of gold will always be worth the same. The following chart impressively illustrates gold's ability to preserve value as an investment. The nominal gold price has increased significantly since 1976, mainly due to inflation and the depreciation of the US dollar.

Chart 1: Nominal and real gold price in USD/oz (basis: 1976)

- Gold tends to have a low or negative correlation with traditional asset classes, such as equities and bonds. This means that adding gold to a portfolio can improve its risk-return profile by reducing the overall risk.

However, against this argument is the fact that...

- Unlike shares and bonds, however, gold does not generate any regular income. Investors can therefore only benefit from price increases.

- A look at the nominal price trend in US dollars shows that the gold price has fluctuated considerably in recent decades. Between 1980 and 2007, for example, it did not generate any significant returns. Investors had to wait 27 years for their investment to yield a positive return. Such extended phases of value stagnation are rarely observed with shares. Over long periods of time, the real price of gold has risen less dramatically than the nominal price. This demonstrates that, while gold has maintained its value, it has not necessarily generated above-average returns compared to other investments, such as shares or property.

Conclusion:

Gold can play a role in a well-diversified portfolio.

What is driving the gold price?

We consider the five main factors that influence the gold price.

These factors are also reflected in the study by Dirk G. Baur, a professor at the University of Technology Sydney, titled Gold – Fundamental Drivers and Asset Allocation.

Several key factors influence the price of gold:

- Inflation: Historically, inflation has been a significant driver of the gold price, particularly in the 1970s and late 2000s. In times of high inflation, the price of gold rises as it serves as a hedge against inflation.

- Interest rates: High interest rates increase the opportunity cost of holding gold, which tends to lead to a fall in its price. However, low or negative real interest rates (i.e. nominal interest rates minus the inflation rate) favour an increase in the gold price.

- Currency changes: The value of the US dollar significantly impacts the price of gold. A weaker dollar generally leads to a higher gold price, as gold is traded in US dollars, making it more attractive to investors using other currencies.

- Central bank reserves: Central bank policy, particularly with regard to the accumulation and expansion of gold reserves, plays an important role. In recent years, central banks, particularly in emerging markets, have increased their gold reserves, thereby supporting the gold price.

Conclusion:

The influence of these factors varies over time. For instance, real yields and the gold price have become somewhat decoupled since the conflict in Ukraine. During this period, structural gold purchases by central banks (diversification away from the US dollar) were one of the factors contributing to the rising gold price. Furthermore, the last few years have shown that the gold price is affected by various factors, such as investor demand (as seen in gold ETF holdings) and trader positions ('non-commercial positioning').

I want to buy gold. What options do I have?

Several...

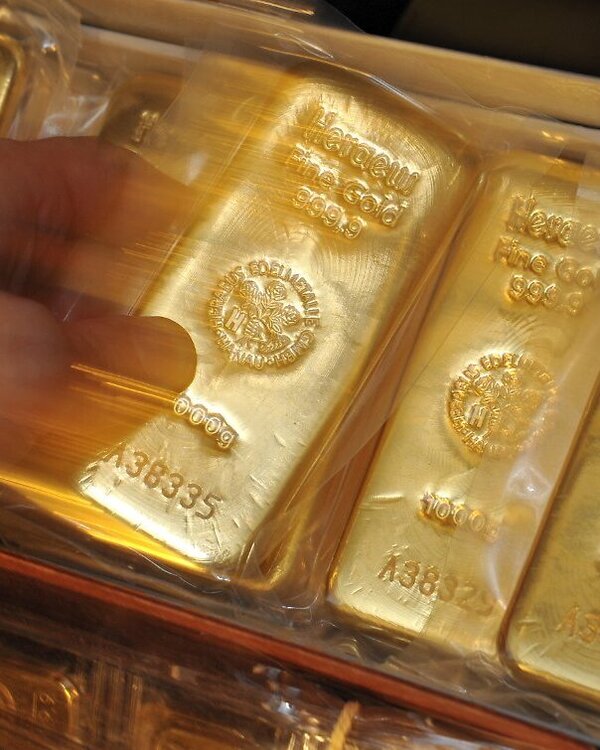

- Physical gold: You can own gold bars or coins directly.

- ETF (Exchange Traded Fund): Simple trading on the stock exchange.

- ETC (Exchange Traded Commodity): Specifically for commodities such as gold.

- Currency XAU: trading in gold as a currency unit.

- Futures: Contracts for the future purchase or sale of gold.

A detailed analysis and further information can be found in the blog article 'Many roads lead to Rome'.

What about sustainability?

Gold has previously been criticised due to sustainability issues. Industry standards and quality seals have therefore been developed to create an international framework.

- Supranational recommendations: Frameworks such as the United Nations Global Compact and the OECD Guidelines promote sustainable trade and reduce the trade of conflict minerals.

- Industry standards: Guidelines such as the LBMA's Responsible Gold Guidance and the World Gold Council's Conflict-Free Gold Standards set minimum standards for responsible gold trading.

- Seal of quality: Initiatives such as Fairtrade, Fairmined, the Swiss Better Gold Association and Green Gold certify gold from sustainable and ethical sources.

- Recycled gold: Reprocessing gold from jewellery and electronic scrap is considered a more environmentally friendly alternative, with re-melting being particularly beneficial.

A detailed analysis and further information can be found in the blog article 'How sustainable is gold?'

Where will the gold price be in five year's time?

Forecasts are tricky, but we will attempt one using the price drivers defined in question 2 and simplified assumptions, while also assuming that all four factors impact the gold price over the next five years.

| Influencing factor | Influencing factor5-year perspective | Our current assessment of the change in the gold price |

|---|---|---|

| Inflation | Higher inflation in sight Now that US inflation has been falling since its mid-2022 peak, several challenges are looming in the coming years: 1. Increased import duties: Further increases in government spending will boost demand for goods and lead to rising prices. It follows from 1 and 2 that a US recession within the next five years cannot be ruled out. |

positive |

| Interest rates | Between inflation and the economic situation Interest rates are significantly influenced by inflation and the future direction of the economy. Increased trade tariffs are likely to lead to higher inflation over the next five years, but they will also weaken economic performance. Therefore, the US central bank will probably have limited scope for adjusting interest rates in the near future. In the long term, interest rates will also be caught between higher inflation risks and a weakening economy. |

neutral |

| Currency change | Overvalued USD Current forecasts suggest that political measures such as Trump's favoured weakening of the dollar could affect confidence in the US currency. Historically, the dollar has been overvalued (see the chart below). According to the purchasing power parity index (PPP), the dollar is overpriced compared to many other currencies, meaning that goods and services are more expensive in the US. |

positive |

| Central bank reserves | Central banks are considering gold purchases Due to the de-dollarisation trend, it is likely that central banks will continue to demand gold over the next few years before stabilisation sets in. Gold's share of total currency reserves remains relatively low, particularly in Asia (e.g. the People's Bank of China). |

very positive |

Chart 2: The purchasing power parity index (PPP) shows that the dollar is overpriced compared to many other currencies.

Conclusion:

In summary, we anticipate a rise in the price of gold over the next five years, potentially reaching USD 5,000/oz. However, the journey there will certainly not be straightforward, but will instead be characterised by volatility and short-term corrections.

Legal Notice

Legal Notice

This publication was prepared by Zürcher Kantonalbank and is intended for distribution in Switzerland. It is not intended for people in other countries.

The information contained in this document has been prepared by Zürcher Kantonalbank with customary diligence. However, no guarantee can be provided as to the accuracy and completeness of the information. The information contained in this publication is subject to change at any time. No liability is accepted for the consequences of investments based on this document.

This information is for advertising and information purposes only and does not constitute investment advice or an investment recommendation. This publication does not constitute a sales offer or an invitation or solicitation to subscribe to or to make an offer to buy any financial instruments, nor does it form the basis of any contract or obligation of any kind. The recipient is advised to review the information, possibly with the assistance of an advisor, to determine its compatibility with their personal circumstances as well as its legal, regulatory, tax, and other implications. The information contained in this publication may be adjusted at any time.

Unless otherwise stated, the information refers to Zürcher Kantonalbank's asset management under the Swisscanto brand, which primarily includes collective capital investments under Swiss, Luxembourg and Irish law (hereinafter referred to as "Swisscanto funds").

The investment opinions and assessments of securities and/or issuers contained in this document have not been prepared in accordance with the rules on the independence of financial analysts and therefore constitute marketing communications (and not independent financial analysis). In particular, the employees responsible for such opinions and assessments are not necessarily subject to restrictions on trading in the relevant securities and may in principle conduct their own transactions or transactions for Zürcher Kantonalbank in these securities.

The sole binding basis for the acquisition of Swisscanto Funds is the respective published documents (fund agreements, contractual conditions, prospectuses and key investor information, as well as annual reports). These can be obtained free of charge from products.swisscanto.com/ or in paper form from Swisscanto Fund Management Company Ltd., Bahnhofstrasse 9, CH-8001 Zurich, which is the representative for Luxembourg funds, and at all branch offices of Zürcher Kantonalbank, Zurich.

Carne Global Fund Managers (Schweiz) AG is the representative for funds domiciled in Ireland. Zürcher Kantonalbank is the paying agent for the Irish Swisscanto funds in Switzerland and Luxembourg funds.

It should be noted that any information about historical performance does not indicate current or future performance, and any performance data provided may not consider the commissions and costs incurred when issuing and redeeming fund units. Any estimates regarding future returns and risks contained in the document are for informational purposes only. Zürcher Kantonalbank does not provide any guarantee for this.

Every investment involves risks, especially with regard to fluctuations in value and return.

With regard to any information on sustainability, it should be noted that there is no generally accepted framework and no generally valid list of factors in Switzerland that need to be taken into account to ensure the sustainability of investments.

For Irish and Luxembourgish Swisscanto funds, information on sustainability-related aspects in accordance with the Disclosure Regulation (EU) 2019/2088 is available at products.swisscanto.com/ .

The products and services described in this publication are not available to US persons in accordance with the applicable regulations. This publication and the information contained in it must not be distributed and/or redistributed to, used or relied upon by, any person (whether individual or entity) who may be a US person under Regulation S of the US Securities Act of 1933. US persons include any US resident; any corporation, company, partnership or other entity organised under any law of the United States; and other categories set out in Regulation S. Status of the data (unless otherwise stated): 03.2025

© 2025 Zürcher Kantonalbank. All rights reserved.

Last updated: March 2025