Euphoria about AI now requires a sober view

AI continues to boost the share price of Nvidia. Other technology companies would like to harness the AI tailwind, but their mileage has varied.

Author: Aryestis Vlahakis

Artificial intelligence continues to drive strong growth at chip maker Nvidia. At USD 61bn, revenue in the just-reported fiscal year was double what the company achieved a year ago. Nvidia's share price has climbed 59 percent since January, after tripling in 2023. Numerous other companies are making efforts to harness the tailwind of the AI narrative, with varying degrees of plausibility and success.

What factual changes did we see around AI in 2023?

Other than Nvidia, only few companies have so far presented concrete revenues based on AI:

- Microsoft’s AI related revenues can be estimated at USD 244mn across the second half of 2023.

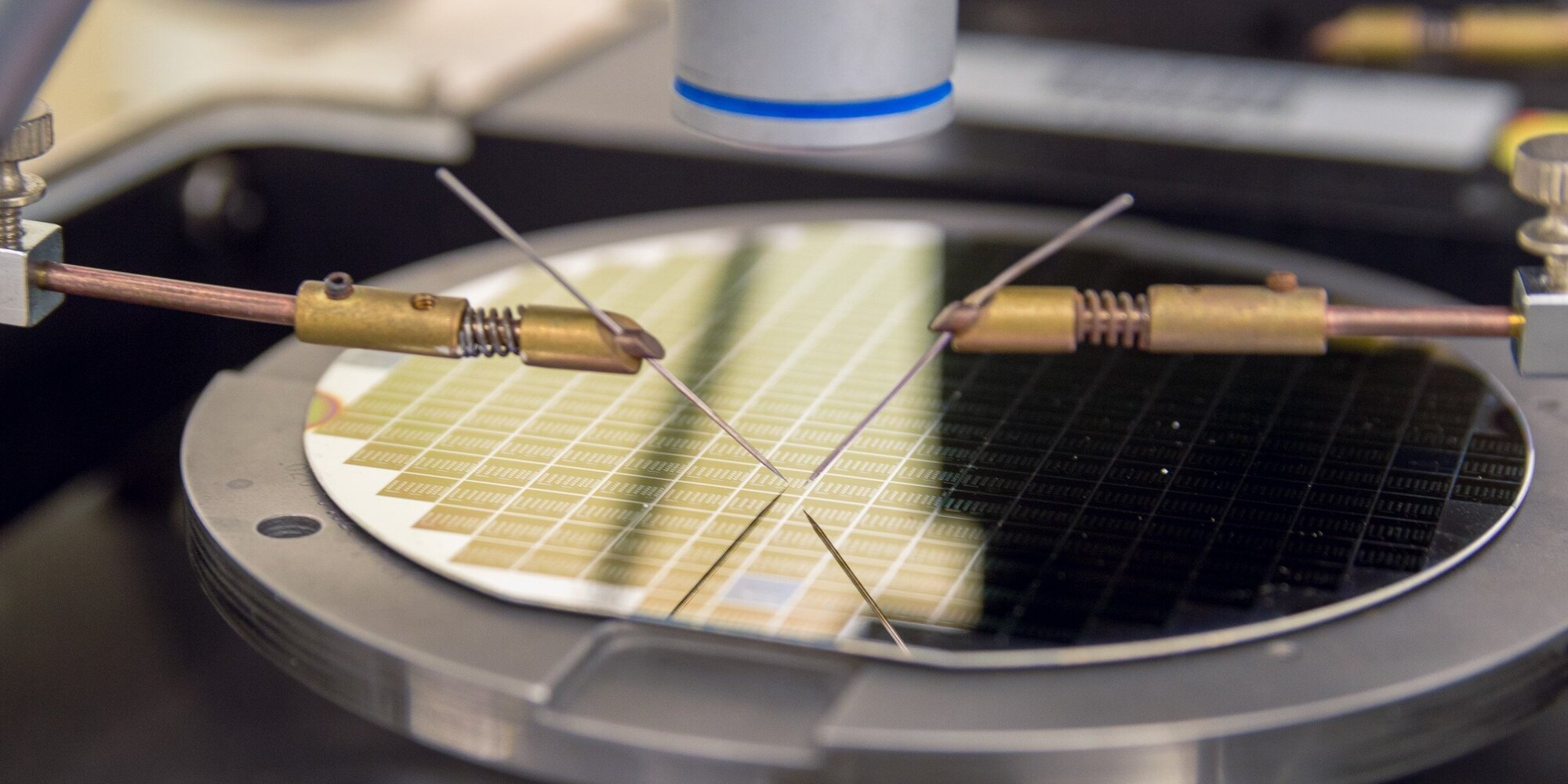

- Cadence and Synopsys are unique providers of semiconductor design tools, essential to AI microchip design. Their revenue growth has accelerated in recent years, collectively increasing by USD 1.3bn in their last fiscal year. The faster revenue growth is the result of acceleration in design activity for AI microchips, and to AI enhancements both companies introduced in their own products.

Multiple other companies have made AI-based product announcements, but most have not yet booked significant revenues from AI-related products. In most cases, share price returns reflect expectations of what AI might be in the future.

What is the AI supply chain?

We can discern an emerging “AI supply chain,” which begins at Nvidia’s graphics processing units (GPUs) and associated software tools. It then continues into the cloud providers, which provide on-demand computing capabilities to the developers of AI software and their final users. Larger companies such as Microsoft or Google are somewhat vertically integrated, as they both own the computing capacity and are developing their own AI software. This emerging ecosystem is supported by the ever-present IT consultants such as Accenture. Based on what we currently know, only specific parts of the AI supply chain will be able to generate sustainable incremental profits from AI.

As investors, we keep three questions in mind

- How much AI uptake will there be?

- How will technology vendors profitably monetize the productivity that AI creates in all sectors of the economy?

- Will AI shift the competitive dynamics, or strengthen incumbents?

- On the first question: At the end of 2023, surveys indicated the majority of IT leaders were closely monitoring how AI could help their companies, but were not yet dedicating significant new funds to AI products. Consumer facing products such as OpenAI's ChatGPT or Google's Gemini (formerly Bard) initially attracted huge user numbers which subsequently tailed off; the revenues they generate from consumers is unclear. Many interesting and revenue generating AI products will come to market in the coming 12 months, though their purpose is likely to test the possible ROI of AI tools rather than immediately maximize revenues for technology vendors.

- On the second question: In case of widespread AI adoption, it is possible that essentially all software companies must offer AI features, but will be unable to charge significant and margin accretive revenues: when word processing software such as Microsoft Word first appeared, features such as printing were only available by purchasing additional software modules. Over time such features became subsumed within the core word processing software. It is possible that AI will follow a similar path, with the user-facing features of AI becoming part of larger software products. In this case, it is likely that consumer facing software companies must all offer AI features simply to keep up with competitors: there will be little scope for charging incremental revenues, or at least profit-generating incremental revenues.

- On the third question: Technology and disruption often go hand in hand, but innovations can also strengthen incumbents. The last 12 months of AI innovations have been driven by technology behemoths such as Microsoft or Adobe. In contrast, the Internet grew through brand new companies like Netscape, Yahoo, and Google. Many of the AI breakthroughs were spearheaded by startups such as Deep Mind and OpenAI, but in partnership with technology giants: Deep Mind was acquired by Google in 2014 and OpenAI began a deepening partnership with Microsoft in 2019. Microsoft's capital expenses were USD 38bn in 2023, while Google spent USD 32bn, a multi-year pattern . This primarily builds cloud computing data centers, essential to AI model development, which currently needs large volumes of computing capacity. There are few companies that can invest so much for a commercially unproven technology, which partly explains why AI has so far not disrupted incumbents.

How are we investing in AI?

Completely betting against AI ignores that technological improvements are the main driver of economic growth, through their effect on productivity. We are monitoring the evolution of AI and evaluating its effect on our holdings. Microsoft, Nvidia and Synopsys are three AI-relevant names we hold in our active, ESG-integrated fundamental strategies.

Legal notice: The publications were prepared by the Buy-Side Research of the Asset Management of Zürcher Kantonalbank. The information contained in this document has not been prepared in accordance with any legislation promoting the independence of financial research, nor is it subject to any prohibition on trading following the dissemination of financial research.